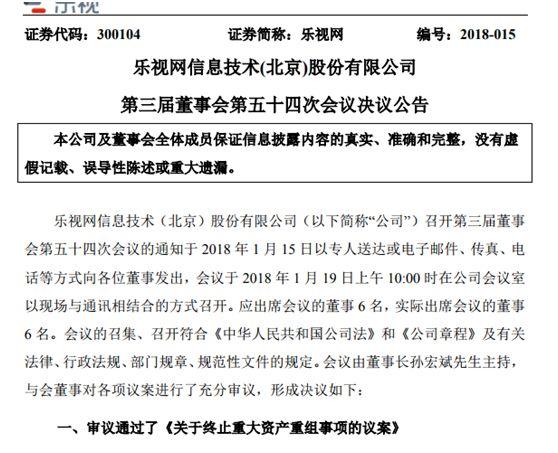

278 days after the suspension of trading, LeTV.com finally released a substantive announcement on the major restructuring. On January 19, the company decided to terminate the major assets reorganization and terminate the change of company name and abbreviation after being reviewed by the board of directors. Although the announcement did not mention the specific resumption time, the reorganization did not clearly have any more reason to continue the suspension.

In the evening, LeTV re-released an announcement stating that there were series of risk warnings such as changes in the actual controller, unrecoverable receivables from related parties, tight cash flow, expired debt, declining performance, external investment, and guarantees.

This day, finally came.

Solution signs?

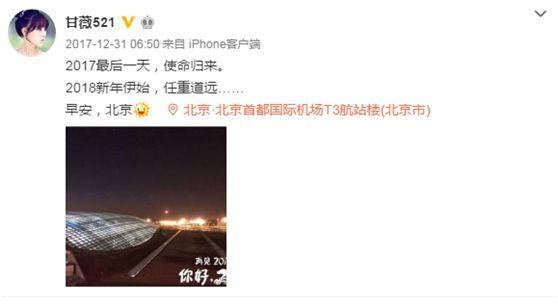

At 6:50 am on December 31, 2017, Jia Yueting's wife, Gan Wei, wrote on Weibo that “On the last day of 2017, my mission will return. At the beginning of the new year of 2018, I will have a long way to go... Good morning, Beijing.â€

On the previous December 25, the Beijing Securities Regulatory Bureau issued a notice ordering Jia Yueting to return to China before December 31, 2017, fulfilling the company's actual controllers' obligations and coping with the company's problems, managing the company's risks steadily, and earnestly protecting investors’ legal rights. rights and interests.

On the afternoon of January 7, Jia Yueting's wife, Gan Wei, posted Weibo and said that she had already resolved some of her debts by means of asset offsets and asset sales. Specifically, she repaid the core assets of LeTV Mall with a consideration of 92.9 million yuan to LeTV.com's subsidiary, LeTV. The wiseman repaid part of the debts of the listed company; the sale of Coolstock shares was repaid to China Merchants Bank by HK$807 million, and the debt repayment ratio was nearly 60%. The next step is to communicate with the China Merchants Bank to unfreeze assets. LeTV’s debt problem seems to usher in a dawn of resolution. However, China Merchants Bank, one of the counterparties, did not respond.

Although ultimately unable to wait for Jia Yueting to return home, LeTV could no longer continue its suspension.

On the first trading day in January 2018, LeTV was also “stripping out†the three indexes of Shenzhen Stock Index, Shenzhen Stock Exchange Index, and GEM Index.

From the large scale, the pursuit of capital, the rising market value to the crisis, the disintegration of business, and the breakdown of funds, the LeTV ecosystem built by Jia Yueting has emerged as a parabola in just three years.

Crisis outbreak

On April 14, 2017, LeTV.com suspended trading. The announcement stated that it was for the acquisition of LeTV Films. Shortly after the implementation of this major asset restructuring plan, the LeTV crisis broke out one after another. Layoffs, financial crisis, related transactions, and cash flow breakups become true portrayals of LeTV during the suspension period.

At LeTV’s press conference on May 21 this year, Jia Yueting also publicly stated that LeTV’s ecology is promising and competitive. This is the core point of LeTV’s ability to win the opponent. The seven sub-ecosystems of LeTV are indispensable.

It is undeniable that LeTV, unlisted systems, and external financing are all three parties that will push LeTV to the altar. However, under the iron locks, the dangers and dangers are under threat. As soon as the crisis has been fermented, the LeTV system will quickly fall into the trap of fighting beasts.

According to Jia Yueting's design, LeTV has seven ecosystems including internet technology, content, large screen, mobile phone, automobile, sports, and finance. The main carriers of content ecology are LeTV and LeTV. The mobile phone ecosystem is mainly LeTV. For LeTV, the sports ecosystem is mainly LeTV Sports. The internet financial ecology is mainly LeTV. The Internet and cloud ecosystem are mainly LeTV, and the large screen ecosystem is LeTV (Super TV).

However, these seven ecology did not produce the expected ecological reversal. The relevant reports are detailed in “Sun Hongbin†or “Became Chairman of LeTV.com. When they stormed, they detached and tried to step on each other when they evacuated. Single music as mobile phones, after Sun Hongbin Sunac China's interim results announcement has been disclosed on the outside, music as mobile phone loss as high as 9.2 billion, becoming the last straw pressure Lelevision.

On June 26, 2017, the storm finally arrived. On the same day, China Merchants Bank Shanghai Chuanbei Sub-branch applied for property preservation from Shanghai Higher People’s Court and requested the freezing of applicants Lefeng Mobile Hong Kong Co., Ltd., Levision Mobile Intelligence Information Technology (Beijing) Co., Ltd., Leshi Holdings (Beijing) Co., Ltd., Jia Yueting, and Gan Wei. The total bank deposits under the name of 1.237 billion yuan, or seizure and detainment of other equivalent assets. At this point, the LeTV crisis broke out in full and openly.

On June 28, Jiayueting expressed at the shareholders’ meeting that in the past four months, the banks had been run on the bank. Not only did the sale of old shares amounted to 9.7 billion yuan, but even the company’s business funds had to be drawn out to repay financial institutions’ borrowings. This directly led to the LeTV experienced a more serious liquidity crisis than it was after November 2016.

On July 4th, LeTV.com announced that it had received a notice from the company's controlling shareholder, Jia Yueting, that its 26.03% stake in LeTV.net had been frozen by the Shanghai Higher People's Court. The reason was "because of the personal joint guarantee provided by LeTV. The property was saved because of public opinion.

On July 24th, CCB Beijing Guanghua Sub-branch applied for property preservation to the court on the grounds of disputes over financial loan contracts. They requested the seizure, seizure or freezing of assets worth RMB 250 million by LeTV, Jia Yueting, LeTV Holdings and Jia Yuemin.

On July 21, LeTV.com held a board of directors and Sun Hongbin was elected chairman of LeTV. According to Sun Hongbin, Jia Yueting's hand-built LeTV ecosystem can do a good job. Or that sentence, the sale is still sold.

On December 25, the Beijing Court Trial Information Network issued a ruling on the case concerning disputes concerning the notarization of creditors' rights between Huafu Securities and Jia Yueting. At this point, Jia Yueting’s domestic assets have all been sealed up. There are no other bank deposits or houses available for execution under his name. Registration records and vehicle registration records.

Thunderbolt mechanism

Once the star stocks, naturally, ultimately, funds and other institutions to join in. After the crisis broke out, Shigekura's funds naturally bear the brunt of it. Since LeTV suspended trading on April 15, the fund has lowered its valuation 3 times successively, from the price of 15.33 yuan before the suspension (Note: August 10, Lexus 10 to 10 0.28, share price ex-rights) all the way down to 3.91 yuan, Valuation plummeted by 74.5%, and the price dropped again.

Not only is the public fund raised during thunderstorms, but from LeTV's third quarterly report in 2017, LeTV's top ten shareholders in circulation also include Central Huijin and the gold asset management plan. There are even celebrity shareholders including Zhang Yimou and Sun Yi who participate in the increase. The shareholder list also shows that there are 186,000 shareholders holding LeTV.

“If the restructuring fails, retail investors are very passive. Even if they are sold, they will not be able to sell. There may be multiple daily stoppages to meet them. After the resumption of trading, the institutions will be interested in this stock. That depends on Sun Hongbin’s LeTV. What kind of prospects there are no stocks that are not of interest to the agency, only prices that are not of interest," said Wang Daixin, a vulture fund manager of a private equity fund.

A business tablet must have powerful business functions. At present, users use tablet products more for entertainment, and insufficient development of commercial value has become a major factor restricting the development of tablet computers. Many far-sighted terminal manufacturers have set their sights on the business tablet field.

Generally speaking, when business users choose tablet PC products, they still focus on "regular items" such as processor, battery, operating system, and built-in applications, especially office software applications, which are a good helper for business users.

First of all, there must be powerful office software such as customer management software, which can record customer data and related information anytime, anywhere. There is also a need for powerful marketing software, software marketing, reducing manual intervention, and one person can handle all the publicity and customer information.

Business Tablet,4k Tablet,5G Tablet

Jingjiang Gisen Technology Co.,Ltd , https://www.gisengroup.com